Will vs Trust, I used to think wills and trusts were just for old rich people. Honestly, I didn’t even know the difference. Then one day a buddy asked me if I had one, and I laughed. “Why would I? I don’t even own that much.” But later I started thinking about it—what would actually happen to my stuff if something happened to me?

Will vs Trust : Everything you need to know

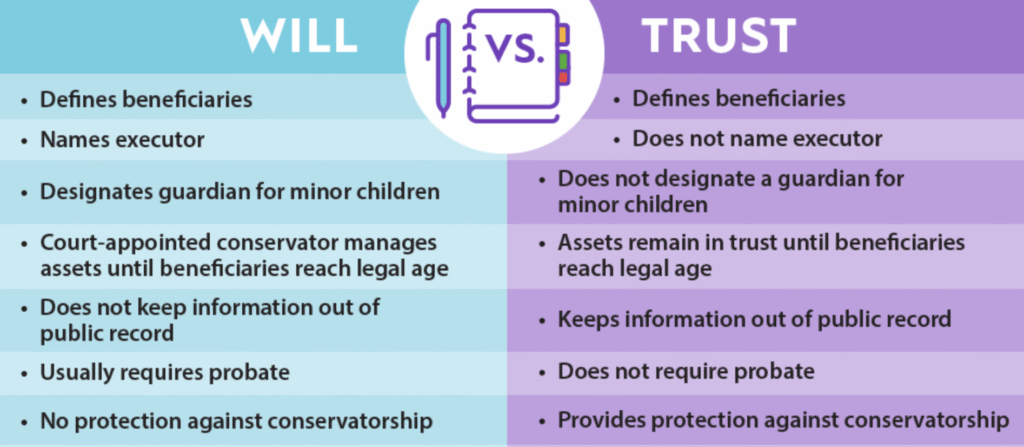

So I did a little digging. I found out a will is basically a set of instructions for after you’re gone. You can write down who gets your things—like your car, savings, or even small stuff that matters to you. And if you have kids, you can say who should take care of them. Sounds simple, right? Will vs Trust, The problem is that a will has to go through probate, which is a fancy word for a court process that takes time and money. Plus, once it’s filed, it becomes public record, which means anybody could look it up.

Also read: Why Opening a Business Can Be Better for Your Personal Taxes?

A trust works differently. I thought of it like a special box you put your stuff in while you’re alive. You set the rules for what happens with it—like who gets it, when they get it, and even what conditions they need to meet. The nice part is, when you pass away, everything in the trust skips probate court, so your family doesn’t have to deal with all that stress. It also stays private, which I liked, and it can even cover situations where you’re still alive but can’t manage your own things, like if you got really sick. The downsides? Will vs Trust, Trusts cost more to set up, they’re more work because you actually have to transfer your property into them, and unlike wills, they don’t let you choose guardians for kids.

When I compared the two, it started to make sense. Wills are cheaper and easier but come with the hassle of probate and no privacy. Trusts are more expensive and take effort, but they give you more control and keep things private. Will vs Trust, I realized it’s not really about being old or having millions—it’s about making life easier for the people you care about.

For me, I figure a will is a good place to start, and when I build up more assets, I’ll probably set up a trust too. Just knowing the difference now makes me feel a little more prepared.

Omar Solari, also known as Omar C Solari and Jorge Antonio Omar Solari, is a Florida-based entrepreneur passionate about wellness, travel, and building meaningful businesses. Proudly American since the age of 20, he shares his experiences to inspire others to live healthier, explore the world, and achieve their goals. Follow Omar Solari on Facebook.

So true

When my parents passed and my grandma took over us, he probate process was excruciating

People need to know and understand the pain it causes to deal with grief and then the government taking some of what’s left from us by making the decision they want

Wills are very important

I’m on my third will and I’m thinking about doing one or 2 more as I grow in business. I want to ensure my kids are on safe hands when I’m not around